SCHD dividend is synonymous with the Schwab U.S. Dividend Equity ETF, an investment avenue that has garnered significant attention in the financial world. This exchange-traded fund (ETF), meticulously crafted by Charles Schwab, zeroes in on high dividend-yielding U.S. stocks. The appeal of the SCHD dividend lies in its ability to provide investors with a steady income stream, making it a favored choice among those seeking reliable financial growth. Here’s how it generally works:

Investment Focus: SCHD primarily invests in U.S. stocks that have a track record of consistent dividend payments. These are often established stable companies with a history of profitability.

Dividend Yield: The fund aims to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Dow Jones U.S. Dividend 100 Index. This index includes 100 high dividend-yielding U.S. stocks.

Diversification: SCHD, like other ETFs, spreads its investments across a range of individual stocks. This diversification helps reduce the risk associated with investing in individual companies.

Passive Management: SCHD, like most ETFs, is passively managed. This means it aims to replicate the performance of its underlying index rather than outperform it. This strategy often results in lower fees compared to actively managed funds.

Dividend Reinvestment: Investors in SCHD typically benefit from dividend reinvestment. This means that the dividends earned from the stocks within the ETF are automatically reinvested to purchase more shares, potentially compounding the investment over time.

SCHD Dividend information

SCHD boasts a dividend yield of 3.67%, having paid shareholders $2.66 per share over the past year. Dividends are distributed quarterly, with the most recent ex-dividend date was on Dec 6, 2023

| Dividend Yield | Annual Dividend | Ex-Dividend Date |

| 3.67% | $2.66 | Dec 6, 2023 |

| Payout Frequency | Payout Ratio | Dividend Growth |

| Quarterly | 50.41% | 3.77% |

SCHD Dividend History

| Ex/EFF DATE | CASH AMOUNT | RECORD DATE | PAYMENT DATE |

|---|---|---|---|

| 12/06/2023 | $0.7423 | 12/07/2023 | 12/11/2023 |

| 09/20/2023 | $0.6545 | 09/21/2023 | 09/25/2023 |

| 06/21/2023 | $0.6647 | 06/22/2023 | 06/26/2023 |

| 03/22/2023 | $0.5965 | 03/23/2023 | 03/27/2023 |

| 12/07/2022 | $0.7034 | 12/08/2022 | 12/12/2022 |

| 09/21/2022 | $0.6367 | 09/22/2022 | 09/26/2022 |

| 06/22/2022 | $0.7038 | 06/23/2022 | 06/27/2022 |

| 03/23/2022 | $0.5176 | 03/24/2022 | 03/28/2022 |

| 12/08/2021 | $0.6198 | 12/09/2021 | 12/13/2021 |

| 09/22/2021 | $0.587 | 09/23/2021 | 09/27/2021 |

| 06/23/2021 | $0.5396 | 06/24/2021 | 06/28/2021 |

| 03/24/2021 | $0.5026 | 03/25/2021 | 03/29/2021 |

| 12/10/2020 | $0.6015 | 12/11/2020 | 12/15/2020 |

| 09/23/2020 | $0.543 | 09/24/2020 | 09/28/2020 |

| 06/24/2020 | $0.442 | 06/25/2020 | 06/29/2020 |

| 03/25/2020 | $0.4419 | 03/26/2020 | 03/30/2020 |

| 12/12/2019 | $0.4658 | 12/13/2019 | 12/17/2019 |

| 09/25/2019 | $0.4855 | 09/26/2019 | 09/30/2019 |

| 06/26/2019 | $0.4209 | 06/27/2019 | 07/01/2019 |

| 03/20/2019 | $0.352 | 03/21/2019 | 03/25/2019 |

| 12/12/2018 | $0.4054 | 12/13/2018 | 12/17/2018 |

| 09/25/2018 | $0.3668 | 09/26/2018 | 09/28/2018 |

| 06/26/2018 | $0.4056 | 06/27/2018 | 06/29/2018 |

| 03/16/2018 | $0.2615 | 03/19/2018 | 03/22/2018 |

| 12/18/2017 | $0.3448 | 12/19/2017 | 12/22/2017 |

| 09/18/2017 | $0.3439 | 09/19/2017 | 09/22/2017 |

| 06/19/2017 | $0.3312 | 06/21/2017 | 06/23/2017 |

| 03/20/2017 | $0.3258 | 03/22/2017 | 03/24/2017 |

| 12/19/2016 | $0.3987 | 12/21/2016 | 12/23/2016 |

| 09/19/2016 | $0.2438 | 09/21/2016 | 09/23/2016 |

| 06/20/2016 | $0.3174 | 06/22/2016 | 06/24/2016 |

| 03/21/2016 | $0.2981 | 03/23/2016 | 03/28/2016 |

| 12/21/2015 | $0.2715 | 12/23/2015 | 12/28/2015 |

| 09/21/2015 | $0.2989 | 09/23/2015 | 09/25/2015 |

| 06/22/2015 | $0.3063 | 06/24/2015 | 06/26/2015 |

| 03/23/2015 | $0.2699 | 03/25/2015 | 03/27/2015 |

| 12/22/2014 | $0.2754 | 12/24/2014 | 12/29/2014 |

| 09/22/2014 | $0.2544 | 09/24/2014 | 09/26/2014 |

| 06/23/2014 | $0.2693 | 06/25/2014 | 06/27/2014 |

| 03/24/2014 | $0.2478 | 03/26/2014 | 03/28/2014 |

| 12/23/2013 | $0.2489 | 12/26/2013 | 12/30/2013 |

| 09/23/2013 | $0.2306 | 09/25/2013 | 09/27/2013 |

| 06/24/2013 | $0.225 | 06/26/2013 | 06/28/2013 |

| 03/18/2013 | $0.1993 | 03/20/2013 | 03/22/2013 |

| 12/24/2012 | $0.2581 | 12/27/2012 | 12/31/2012 |

| 09/17/2012 | $0.2078 | 09/19/2012 | 09/21/2012 |

| 06/18/2012 | $0.2062 | 06/20/2012 | 06/22/2012 |

| 03/19/2012 | $0.1379 | 03/21/2012 | 03/23/2012 |

| 12/19/2011 | $0.1217 | 12/21/2011 | 12/23/2011 |

SCHD Stock Holdings

As of September 29, 2023, the fund had 104 holdings with a total net asset value of $47,575,942,252.77. The top 10 holdings of the fund constitute approximately 40.9% of its portfolio. The following table shows the top 10 holdings of SCHD as of September 29, 2023, along with their respective sectors:

| Rank | Symbol | Name | % Weight | Sector |

|---|---|---|---|---|

| 1 | AMGN | Amgen Inc. | 4.45% | Health Care |

| 2 | ABBV | AbbVie Inc. | 4.28% | Health Care |

| 3 | CVX | Chevron Corporation | 4.19% | Energy |

| 4 | MRK | Merck & Co., Inc. | 4.01% | Health Care |

| 5 | PEP | PepsiCo, Inc. | 3.97% | Consumer Staples |

| 6 | AVGO | Broadcom Inc. | 3.91% | Information Technology |

| 7 | VZ | Verizon Communications Inc. | 3.90% | Communication Services |

| 8 | KO | The Coca-Cola Company | 3.89% | Consumer Staples |

| 9 | TXN | Texas Instruments Incorporated | 3.88% | Information Technology |

| 10 | CSCO | Cisco Systems, Inc. | 3.86% | Information Technology |

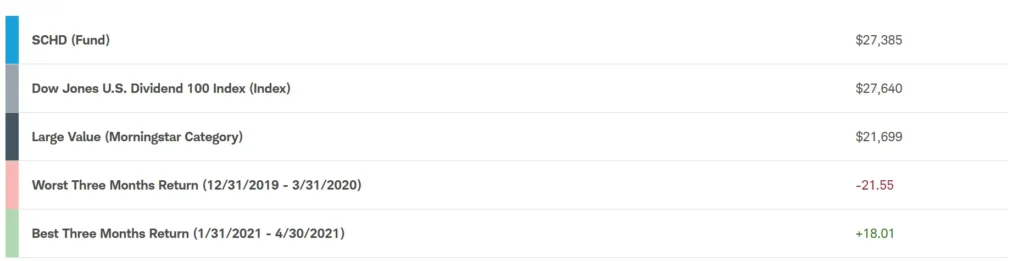

Cumulative Growth of a $10,000 Investment (As of 09/30/2023)

This chart illustrates the progress of an imaginary investment starting with $10,000. It considers the reinvestment of dividends and capital gains, excluding sales loads, applicable redemption fees, and the impact of taxes on capital gains and/or distributions. If the Index’s start date is within the timeframe displayed above, the period since inception is depicted. The chart also indicates the best and worst returns during the charted period.

Pros of Investing in SCHD:

1. Stability and Consistent Returns:

SCHD offers stability and consistent returns, making it an attractive choice for conservative investors. It focuses on established, dividend-paying companies, which tend to be more stable during market fluctuations.

2. Dividend Income:

Investors seeking regular income appreciate SCHD’s strong dividend yield. It provides a steady stream of income, making it a suitable option for income-focused portfolios.

3. Diversification:

SCHD provides diversification across various sectors and industries. By investing in multiple dividend-paying companies, it spreads the risk, reducing the impact of poor performance by any single company.

4. Low Expenses:

SCHD has a low expense ratio (0.060%), minimizing the impact of fees on overall returns. This cost-effectiveness is attractive for long-term investors looking to maximize their returns.

5. Historical Performance:

Historically, SCHD has delivered competitive returns, outperforming many other dividend-focused ETFs. Its track record can instill confidence in investors.

6. Tax Efficiency:

SCHD’s structure often leads to tax efficiency, which is advantageous for investors, especially those in higher tax brackets.

Cons of Investing in SCHD:

1. Market Risk:

Like all investments, SCHD is exposed to market risks. Economic downturns or bear markets can affect the fund’s performance, leading to potential losses.

2. Limited Growth Potential:

Dividend-focused ETFs like SCHD may have limited exposure to high-growth companies, which could hinder capital appreciation opportunities.

3. Interest Rate Sensitivity:

Rising interest rates can negatively impact dividend-paying stocks, affecting SCHD’s performance. Investors need to be aware of interest rate trends.

4. Sector Concentration:

While SCHD diversifies, it may still have a concentration in certain sectors. Changes in these sectors can significantly impact the fund’s value.

5. Dependency on Dividend-Paying Companies:

SCHD relies on companies that pay dividends. If a company reduces or eliminates its dividend, it could affect SCHD’s overall dividend income.

6. Management Risk:

While SCHD has a low expense ratio (0.06%), the performance is still influenced by the fund manager’s decisions. In case of management changes, the fund’s strategy might shift.

How to use SCHD to build a dividend income stream

Building a dividend income stream using the Schwab U.S. Dividend Equity ETF (SCHD) involves strategic planning and a long-term investment approach. Here’s a step-by-step guide on how to use SCHD to generate a consistent dividend income:

1. Understand Your Financial Goals:

Before investing in SCHD, define your financial goals, such as the amount of income you need, your investment timeline, and your risk tolerance. Knowing your objectives will help you make informed decisions.

2. Research SCHD:

Understand SCHD’s investment strategy, holdings, historical performance, and expense ratio. Research its top holdings, sectors, and dividend history. Make sure SCHD aligns with your income needs and risk tolerance.

3. Invest Regularly:

Consistent investing, whether monthly or quarterly, can help you take advantage of dollar-cost averaging. This strategy involves investing a fixed amount regularly, which can lower your average cost per share over time.

4. Reinvest Dividends:

Consider reinvesting the dividends you receive from SCHD back into the fund. This process, known as dividend reinvestment, allows you to purchase additional shares, compounding your investment and increasing your future dividend income.

5. Dividend Reinvestment Plan (DRIP):

DRIPs automatically reinvest your dividends into more shares of the ETF, facilitating compounding and maximizing your income potential.

6. Diversify Your Investments:

While SCHD provides dividend income, consider diversifying your investment portfolio. Diversification reduces risk by spreading your investments across different asset classes, sectors, and geographic regions.

7. Monitor and Adjust:

Regularly monitor SCHD’s performance, market trends, and your financial goals. Reassess your portfolio periodically and make adjustments as needed. Consider consulting a financial advisor for professional guidance.

8. Tax Efficiency:

Understand the tax implications of your dividend income. SCHD’s structure often leads to tax efficiency, but it’s essential to be aware of the tax laws applicable to your investment income.

9. Long-Term Approach:

Building a sustainable dividend income stream takes time. Adopt a long-term investment approach, staying patient and disciplined. Avoid making impulsive decisions based on short-term market fluctuations.

10. Emergency Fund and Risk Management:

Ensure you have an emergency fund for unexpected expenses. Additionally, consider having a comprehensive risk management plan, including health and life insurance, to protect your investments and family’s financial well-being.

Retirement planning with SCHD

Retirement planning is a critical financial goal that requires careful consideration and strategic investment choices. Including SCHD (Schwab U.S. Dividend Equity ETF) in your retirement portfolio can be a prudent decision, given its focus on dividend-paying stocks. Here’s how you can plan for retirement using SCHD:

1. Stable Dividend Income:

SCHD provides a stable dividend income stream, making it an ideal choice for retirees who rely on dividends for regular income. The fund’s focus on established, dividend-paying companies ensures a consistent payout, offering financial security during retirement. While SCHD ETF provides a reliable income stream for retirees, exploring other dividend-paying ETFs, such as JEPQ, can broaden your investment horizon.

2. Regular Dividend Payouts:

Investing in SCHD allows retirees to benefit from regular dividend payouts, which can supplement other sources of retirement income, such as pensions or Social Security. These payouts provide a predictable income, essential for budgeting during retirement.

3. Dividend Reinvestment:

Retirees can opt for dividend reinvestment, where the dividends received from SCHD are automatically reinvested to purchase additional shares. This strategy enables the compounding effect, leading to increased future income, making it a valuable approach for long-term retirement planning.

4. Diversification and Stability:

SCHD offers diversification by investing in a broad range of dividend-paying sectors. Diversification spreads risk and provides stability to a retirement portfolio. A stable, diversified portfolio is vital during retirement to mitigate market volatility.

5. Potential for Growth:

While SCHD primarily focuses on dividend income, it also offers the potential for capital appreciation. By investing in well-established companies, SCHD allows retirees to benefit from the growth of these businesses, leading to potential wealth accumulation over time.

6. Low Expenses and Tax Efficiency:

SCHD has a low expense ratio, ensuring that a significant portion of the investment works towards generating returns. Additionally, the fund’s structure often leads to tax efficiency, allowing retirees to optimize their after-tax returns.

7. Long-Term Approach:

Retirement planning involves a long-term perspective. SCHD’s historical performance and focus on dividends align with the long-term investment horizon typically associated with retirement planning. Retirees can benefit from the fund’s consistent performance over time.

8. Professional Guidance:

While SCHD can be a valuable component of a retirement portfolio, it’s crucial for retirees to seek professional financial advice. A certified financial planner can help create a tailored retirement plan that integrates SCHD effectively with other retirement assets, aligning with specific retirement goals and risk tolerance.

Must Read: Exploring JEPQ Dividend | A Deep Dive into JEPQ Dividend History Unveiling JEPI Dividend | JEPI Dividend History

Case Study: Maximizing Dividend Income for Retirement

Investor Profile: John is a 45-year-old investor who is planning for his retirement, which is 20 years away. He is looking for a stable investment option that can provide regular income during his retirement years.

Financial Goal: John’s primary goal is to build a substantial dividend income stream to support his retirement lifestyle.

Strategy: John decides to invest a significant portion of his portfolio in SCHD due to its focus on high dividend-yielding U.S. stocks. He plans to reinvest the dividends earned from SCHD over the years to take advantage of the power of compounding.

Outcome:

1. Regular Investments: John consistently invests a portion of his monthly income into SCHD, taking advantage of dollar-cost averaging. This strategy allows him to buy more shares when prices are low and fewer shares when prices are high, potentially maximizing his returns over the long term.

2. Dividend Reinvestment: John opts for the Dividend Reinvestment Plan (DRIP) offered by SCHD. This means that the dividends he receives are automatically reinvested to purchase additional SCHD shares. Over the years, this reinvestment significantly increases his investment in SCHD.

3. Long-Term Growth: As SCHD focuses on stable, dividend-paying companies, John’s investment grows steadily over the years. The compounding effect of reinvested dividends, combined with the fund’s capital appreciation, helps his investment flourish.

4. Retirement Income: By the time John reaches retirement age, his investment in SCHD has grown substantially. He decides to stop reinvesting dividends and instead uses the regular dividend payouts as a source of income. The consistent and reliable income from SCHD helps him maintain his desired lifestyle during retirement.

5. Peace of Mind: Knowing that he has a steady and reliable source of income from his SCHD investment, John enjoys his retirement without worrying about financial instability.

While this case study is fictional, it illustrates how an investor might utilize SCHD to achieve their goal of building a reliable dividend income stream for retirement.